If you’re a member of IQ Credit Union and need to check your credit account, just log in to their official website. They provide different money services like savings, checking, loans, mortgages, and credit cards. We’ll guide you through the easy steps to access your account on this page.

Well, you need to create an IQ Credit Unio account before you can access it. You’ll find instructions on how to create an account, how to Register the account and how to log in to your account.

How to Create an IQ Credit Union Account

It’s easy to create an IQ Credit Union account, you’ll need the following steps:

Note: To keep your personal information confidential, they will not be storing any information entered into any of the above applications after the application has been inactive for more than 15 minutes.

Because you will have to start the application from the beginning after 15 minutes of inactivity, please plan accordingly when you are completing an application.

- Go to their official webpage, with any web browser of your choice.

- Enter the “Open an Account” button at the top part of the screen to move to the next page.

- On the next page, under Apply Today header click “Join IQ Credit Union (New Membership)“

- Then Select your eligibility and click on “Continue“

- After that, fill in your Personal Information, Current Physical Address, SContact Information, Identification, About Your Employment, and Additional Information.

- Now click on the “Continue” button and follow the remaining on-screen process.

If you are done with that, you can have your account. Once you have created an account with them, you can log in with the information below.

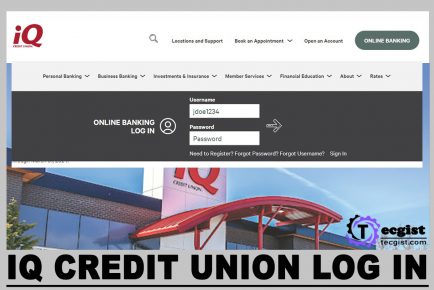

IQ Credit Union Log in

Note: You have to register your account before you can log into it, you can do this with the information below. For IQ Credit Union Login here are the simple steps:

- Go to their official webpage, with any web browser of your choice.

- Enter the “Online Banking” Button to move to the next page.

- On the login section, enter your username and password of your credit union account.

- Select the “Sing In“

You will access your account if you fill in the correct user ID and password. If the email or password is not correct, Confirm if it is or click on forgot email or forgot Password to create a new one or find your account email.

How to Register Your IQ Credit Union Account

To Register Your IQ Credit Union Account:

- Visit their account registration page, with a web browser of your choice.

- Then click on the type of account you want to either “Register to my individual account” or “Register to my business account“

Register to my individual account

- Then read the Disclosure, click on the I agree box and open the PDF documents.

- Copy the 5-character code into the text below and click on the “Continue” button.

- On the next page fill in your Member Number, Social Security Number, Email, Brith date, and Zip code.

- After that, follow the remaining on-screen process to register Your IQ Credit Union personal account.

Register to my business account

Select this if you have a business account.

- Then read the Disclosure, click on the I agree box and open the PDF documents.

- Copy the 5-character code into the text below and click on the “Continue” button.

- On the next page fill in your Member Number, Social Security Number, Email, Zip code, and Phone Number.

- After that, follow the remaining on-screen process to register Your IQ Credit Union business account.

That is all you have to do to Register Your IQ Credit Union Account, your account must be registered before you will be able to log in with the steps above.

IQ Credit Union Service

If you still have trouble using IQ Credit Union or more after reading this article, please contact their customer service for further assistance. To contact IQ Credit Union Customer Service;

- Using an internet-connected web browser, go to the official home page

- Scroll down, and you Will see the talk to us option at the bottom of the screen and their contact number.

You can also physically visit a branch using this link to find one nearby.

About IQ Credit Union

As a member of iQ Credit Union, you get friendly, personalized service for all of your banking needs. Whether you are planning for your first car or your first home, getting ready for college or retirement, iQ is here to help you at every step of life’s journey. See why our local approach gives you a more rewarding path to personalized banking.

IQ Credit Union Benefits

-

Credit unions are not-for-profit cooperatives owned by their members

If you join a credit union, all the profits from the credit union go back into services to benefit you—its member. This typically translates into better rates on interest for savings accounts and loans.

-

Credit unions are federally insured just like banks, so your money is secure

Credit union accounts are insured for up to $250,000 by the National Credit Union Administration (NCUA).

-

Credit unions have a reputation for delivering superior customer service and satisfaction

You are a member instead of a customer and own shares in the credit union.

FAQs

What if my iQ Visa card is lost or stolen?

If you discover your card has been lost or stolen, call the Member Contact Center immediately at 360-695-3441 or 800-247-4364.

If you are travelling outside the United States, please call 727-572-7723 to block your card immediately. You may stop at a local branch to receive a new card the same day or call us during business hours to order a new card by mail.

Are there limits on funds transfers?

There are limits imposed by Federal Regulation D on the number of transfers you can make from your Savings or Money Market Account. (These are remote or automated transfers without your physical presence at a branch.) The types of transfers subject to these limitations include:

- Overdraft transfers are made automatically to cover insufficient funds

- Transfers made by Member Service Representatives on your behalf that are requested by phone or secure email

- Automated, scheduled, preauthorized, or recurring transfers

- Transfers made through online or mobile banking

- Transfers made through telephone banking

Six transfers are allowed per savings account per calendar month, either to another iQ account or to a third party.*

How do I change my name on my accounts?

You can change your name in person by visiting any of our branches or by calling 360-695-3441. You will be asked to provide legal proof of your name change (i.e., marriage license, court document or government-issued ID), as well as sign for the name change request.

Other Login

- Transform Credit Login

- Freedom Mortgage Login

- Castle Credit Login

- Big Star Credit Login

- Explore Credit login

- Concora Credit Login

- United Auto Credit Login

- Avio Credit Login

- Farm Credit Login

- Flagship Credit Acceptance Login

- Patelco Credit Union Login

- Credit Central Login

- Maps Credit Union login

- Charter Oak Federal Credit Union Login

- Security Service Federal Credit Union Login

- Credit Genie Login

- Credit Hero Scores Login

- Mainstreet Credit Union Login

- Quick Credit Connect Login

- Team One Credit Union Login

- Westconsin Credit Union Login

- Credit Key Login

- Fortera Credit Union Login

- Minnco Credit Union Login

- Florida Blue login

- Care Credit Provider Login